Overview Of Estate Planning Issues by Lawrence A. Frolik, J.D., L.L.M Professor of Law University of Pittsburgh, School of Law

When parents have a son or daughter with any type of disability, they must plan their estates carefully to best benefit that child. How parents leave their assets after death may greatly affect the quality of life for their son or daughter with special needs. This article presents basic information to help parents begin considering the very important issues involved in developing an estate plan when the future of a son or daughter with a disability must be taken into account.

Many families believe that they have so few assets that an estate plan is not necessary. This is not true. We often have more assets than we realize, although some assets may become important only after our death. The most notable asset of this type is life insurance. Therefore, whether you consider yourselves a family of substantial means or with little or no assets, estate planning should be done.

How the Type of Disability Affects Estate Planning

Disabilities, of course, can take many forms and have varying degrees of severity. The nature and severity of your child’s disability will affect the nature of the estate plan that you, as parents, develop.

Physical disabilities or health impairments. Many individuals have physical disabilities or health impairments that do not affect their ability to manage financial or other affairs. If your son or daughter has such a condition, how to leave your estate depends on a number of factors. The primary factor will be whether or not your son or daughter receives (or may one day need to depend on) government benefits such as Supplemental Security Insurance (SSI), subsidized housing, personal attendant care, or Medicaid. If your child does receive (or may one day need to depend on) government benefits, then it is most important to create a special estate plan that does not negate his or her eligibility for those benefits. How to do this is discussed in some detail in this NEWS DIGEST.

On the other hand, you may have a son or daughter with a physical disability or health impairment who is not eligible for or who is not receiving government benefits. In this case, you may be able to dispense with elaborate planning devices and merely leave your child money outright, as you would to a nondisabled child. If you believe that the disability may reduce your son or daughter’s financial earning capability, you may want to take special care to leave a greater portion of your estate to this child than to your nondisabled children.

There are some exceptions to this simplified approach, of course. One exception is when parents are somewhat fearful of their son or daughter’s financial judgment. If you are concerned that your son or daughter with a disability may not responsibly handle an inheritance, then you can utilize a trust, just as you would for a nondisabled heir. Another exception is if your child’s disability or health impairment involves the future possibility of deteriorating health and more involved health care needs. While your son or daughter may be capable of earning money and managing an inheritance at present or in the immediate future, in twenty or thirty years time deteriorating health may make it difficult for him or her to maintain employment or pay for health care. Government benefits might then become critical to your child’s security. Remember, benefits include much more than money; your child may also be eligible for valuable services such as health care, vocational rehabilitation, supported employment, subsidized housing, and personal attendant care. If, however, he or she acquires too many assets through inheriting all or part of your estate, he or she may be ineligible for these benefits. Therefore, in order to protect your son or daughter’s eligibility for government benefits at some point in the future and to provide for his or her long-range needs, you may need to consider establishing a special estate plan.

Cognitive disabilities or mental illness. If your son or daughter’s disability affects his or her mental capability, the need to create a special estate plan is more clearcut. Mental illness and cognitive disabilities often impair a person’s ability to manage his or her own financial affairs, while simultaneously increasing financial need. As a result, you must take care to ensure that there are assets available after your death to help your son or daughter, while also providing that the assets are protected from his or her inability to manage them. More information will be given later in this article about various ways to accomplish this. First, however, let us take a look at some basic information about wills and why a will is so important.

Writing a Will

All parents, but particularly parents of individuals with disabilities, should have a will. The object of the will is to ensure that all of the assets of the deceased parent are distributed according to his or her wishes.

If at death you have no will, your property will be dispersed according to the law of the state in which you live at the time of your death. This law is called the state’s law of intestacy. Although laws of intestacy vary from state to state, in general they provide that some percent of assets of the decedent passes to the surviving spouse and the rest is distributed to the children in equal shares. Writing a will is highly recommended, since the laws of intestacy are rarely the most desirable way to pass property to one’s heirs.

Although it is theoretically possible for any individual to write a will on his or her own, it is unwise to do so. Because of the technical nature of wills, it is highly advisable to have a lawyer prepare one. Parents of individuals with disabilities particularly need legal advice, because they often have special planning concerns. If you do not have a lawyer, you can call the local bar association, which will provide you with the name of an attorney in your vicinity. It is preferable, however, to contact a local disabilities group, which may be able to put you in contact with an attorney familiar with estate planning for parents of persons with disabilities. Not all lawyers are familiar with the special needs associated with caring and providing for individuals with disabilities. Before you hire a lawyer, be sure to find out if he or she has ever prepared estates for other parents who have sons or daughters with disabling conditions. If the lawyer has not, it is best to find a more experienced attorney. The cost of an attorney varies according to the attorney’s standard fee and the complexities of the estate. The attorney can quote you a price based upon an estimation of the work. If the price quoted is beyond your immediate means, it may be possible to negotiate a payment plan with the attorney, whereby you pay over time.

When making a will, however, remember that not all the assets you control are governed by a will. Joint property with right of survivorship, for example, passes independently of a will. If, for example, Tim and Sarah own a house as joint owners with rights of survivorship, upon Tim’s death Sarah automatically inherits the house without regard to what Tim’s will might say. Similarly, life insurance is paid out to the named beneficiary without regard to the will. The insurance is a contract between the owner and the insurance company, and the insurance company must pay the insurance to whomever the owner states. Many individuals have death benefits under an employer-provided pension plan. These, too, are not governed by the will but are paid to whomever the employee has designated. (Note: If you create a special estate plan to provide for your child with a disability — in particular, if you set up a special needs trust — review any life insurance policies you have purchased, and be sure that you have not designated your child as a beneficiary. The same is true for relatives who may have designated your child as the beneficiary of their policies.)

Personal property, such as clothing, furniture, and household effects, should be distributed by the will independently of the often more valuable assets such as stocks, bonds, and real estate. Personal property is often of great sentimental importance, but may have little financial value. To avoid disharmony after the death of the last parent, it is generally a good idea to make an equal division of the personal property among the children. In some cases, the parents may wish not to include the child with the disability in the division, particularly if that might disqualify this person from government benefits. However, in most cases it is advisable to leave the person with a disability a share of the personal property so that he or she does not feel excluded.

Remember, a will goes into effect only upon the death of the person who created it. Until death, the creator of the will can freely revoke, alter, or replace it.

How To Start Planning Your Estate: What to Consider

When parents have a son or daughter with a disability, they should give careful consideration to developing an estate plan that provides for that person’s future best interests. Here are some suggestions that can help parents approach planning their estate when a son or daughter with a disability must be taken into consideration.

First: Realistically assess your son or daughter’s disability and the prognosis for future development. If necessary, obtain a professional evaluation of your child’s prospects and capability to earn a living and to manage financial assets. If your son or daughter is already an adult, you should have a fairly clear understanding of his or her capabilities. But if your child is younger, it may be more difficult to predict the future. In such cases, you should take a conservative view. It is better to anticipate all possibilities, good and bad, in such a way that you do not limit your loved one’s potential or set him or her up for unrealistic expectations. Remember, too, that you can change your estate plan as more information about your child becomes available.

Second: Carefully inventory your financial affairs. Estimate the size of your estate (what you own) if you should die within the next year or the next ten years. Keep in mind that the will you write governs your affairs at the time of your death, and so it must be flexible enough to meet a variety of situations. Of course you can always write a new will, but you may never actually write it due to hectic schedules, procrastination, or oversight. Thus, the will you have written must have sufficient flexibility to meet life’s everchanging circumstances.

Third: Consider the living arrangements of your son or daughter with a disability. Your child’s living arrangements after your death are of paramount importance. Every parent of an individual with a disability should give thought to the questions, “If my spouse and I should die tomorrow, where would our child live? What are the possibilities available to him or her?” The prospective living arrangements of your son or daughter will have a tremendous impact on how your estate should be distributed. Involved in answering the question of living arrangements is whether or not your child will need a guardian or conservator to make decisions for him or her after your death. If you conclude that a guardian or conservator is necessary, you should be prepared to recommend a potential guardian or conservator in your will.

Fourth: Analyze the earning potential of your son or daughter. It is important to determine how much your child can be expected to contribute financially, as a result of employment. If he or she is currently employed, does this employment meet all of his or her living expenses, or only some? If your child is presently too young to be employed, you will have to project into the future. In many cases, even if your son or daughter is employed or expected to be employed at some point in the future, he or she will require additional financial assistance.

Fifth: Consider what government benefits your son or daughter needs and is eligible to receive. Support for a person with a disability will usually come from state and federal benefits. These might be actual case grants, such as social security or supplemental security income, or they might be in-kind support programs, such as subsidized housing or sheltered workshop employment.

In brief, government benefits can be divided into three categories. First are those categories that are unaffected by the financial resources of the beneficiary. For example, social security disability insurance (SSDI) beneficiaries receive their benefits without regard to financial need. Regardless of what the parents leave to a son or daughter with a disability, the social security payments will still be forthcoming once the person has qualified for them.

Second, some government benefits, such as supplemental security income (SSI) and Medicaid, have financial eligibility requirements. If a person with a disability has too many assets or too much income, he or she is not eligible to receive any or all of these benefits. Someone who is eligible due to a lack of financial resources can become ineligible upon inheriting money, property, or other assets. This would lead to a reduction or termination of the SSI benefits for that person. Therefore, if your son or daughter is receiving government benefits that have financial eligibility requirements, it is important to arrange your estate in a manner that will minimize his or her loss of benefits, especially SSI or Medicaid.

Finally, there are government programs available to individuals with disabilities where payment for services is determined according to the person’s ability to pay. Many states will charge the individual with a disability for programmatic benefits if he or she has sufficient assets or income. The most striking is the charge that can be levied against residents of state mental institutions. For example, if a resident of a state hospital inherits a substantial sum of money, the state will begin charging the resident for the cost of residency in the state hospital and will continue to charge until all the money is exhausted. Yet the services provided will be no different from the ones that he or she was previously receiving.

Establishing a Will: Four Possible Approaches

Having decided what your son or daughter needs and what you own, you can now consider how best to assist him or her. There are four possible ways to do so.

First, you can disinherit your son or daughter with the disability. No state requires parents to leave money to their children, disabled or not. If your assets are relatively modest and your son or daughter’s needs relatively great, the best advice may be to disinherit your child by name and have him or her rely upon federal and state supports after your death. This may be the wisest decision, particularly if you wish to help your other children. Instead of complete disinheritance, you might leave your son or daughter with a disability a gift of modest but sentimental value, such as his or her bedroom furniture. The value of the gift will be small enough not to affect government benefits, but it will indicate your love and concern.

Second, you can leave your son or daughter with a disability an outright gift. For example, suppose your son Tom has a physical disability. You might write a will that states, “I leave one-third of my estate to my son, Tom.”

If your child with a disability is not receiving (and is not expected in the future to need) government benefits, this may prove to be a desirable course of action. Your son or daughter, if mentally competent, can hire whatever assistance he or she needs to help with managing the gift. But if your son or daughter has a mental illness or cognitive disability, an outright gift is never a good idea, because this person may not be able to handle the financial responsibilities. If you want to leave a gift to support your child, the use of a trust is far preferable.

Third, you can leave a morally obligated gift to another of your children. Suppose, for example, that the parents have two children: James, who has mental retardation, and Mary, who has no disabilities. The parents leave all of their assets to Mary. Legally, Mary now owns all of the parents’ assets and James owns nothing. But prior to their deaths, the parents told Mary that, although they are leaving everything to her, they expect her to use at least half of the money to assist James in whatever way Mary thinks best. They left the money to Mary, because they do not wish James to lose his government benefits, and they think that there are ways that Mary could use the money to help her brother. For example, Mary might provide special gifts to James on holidays or pay for special assistance for James that would not be provided by the government benefit programs. The gift is a moral obligation to Mary, because legally she can ignore the parents’ wishes and do whatever she wants with the money: It is hers. It is only her conscience that guides her. After the parents’ death, if Mary chooses to ignore James and use the money for herself, there is nothing James or anyone else can do about it. Morally obligated gifts are often used by parents with modest-sized estates for whom a trust does not seem desirable. The danger of morally obligated gifts is, of course, that the morally obligated recipient — in our example, Mary — may ignore the wishes of the parents. Even if Mary does not deliberately ignore the obligation, she may encounter circumstances that make it impossible for her to carry out her parents’ wishes. Suppose, for example, that Mary or her children become ill or are in great financial need. She may feel under pressure to use the money for her own family, even if it means that James goes unhelped. Moreover, if Mary dies before James, it is possible that Mary’s family will not carry on the duty to help James. Finally, in case Mary is divorced, the money may be lost to her former spouse in a settlement.

Morally obligated gifts, therefore, are not a complete solution. They can be useful, however, especially when the parents have a modest amount of money and do not expect a lifetime of care for their son or daughter with a disability. Rather, they merely want their nondisabled sons or daughters to use some of the inherited money to assist their sibling with special needs.

Fourth, you can establish a trust for your son or daughter with a disability. For many parents who have a child with disabilities, the use of a trust is the most effective way to help that individual. The point of a trust is to keep assets in a form that will be available to your son or daughter but that will not disqualify him or her for government benefits for which he or she might otherwise be eligible.

The article in this NEWS DIGEST entitled “The Special Needs Trust” discusses in some detail what a trust is, the circumstances under which a trust is advisable, and issues to consider when establishing a trust.

In A Parent’s Words

It had been in the back of my mind for years, soon after I found out my son Samuel had this lifelong disability. What would the future hold for him when I wasn’t there anymore to be his advocate, friend, and supporter? It was both a big and little worry. Big, because it gave me a hole in my gut whenever the questions crept in. And little, in the sense that I tried not to think about it. I’d think: I’ll worry about that tomorrow, next week, when he’s older, when I’m older.

Of course, I’ve done things to prepare Samuel for that future he’s going to have without me, things like teaching him how to wash clothes and shop. But could I write a will? Make an estate plan? No, for years, I dodged that one totally.

Then, when his voice started to change, it suddenly hit me that he was growing up, that he was older now. That future I was always worrying about, and refusing to worry about, was beginning to arrive. I talked with my husband, and I found out he’d been worrying about Sam’s future, too. So he and I went to our lawyer. I was so nervous, to bring all the questions out in the open and look at them. No wonder I’d shoved them under the bed for so long!

But you know, it’s funny. Now that we’re finished setting up our estate and only need periodically to review our plans, I feel like an enormous burden has been lifted up from me. The big, black, scary shadow is gone. Well, not totally gone, I suppose. I still worry about Samuel, what will happen to him in his life. I guess every parent does that. But now I don’t worry in the same way. I know I’ve done all I can do for that part of his future, something that was extremely important to do, and I am very relieved. Now I feel like we can deal fully with the present day and see to the other things that need to be done to prepare Samuel for life as a man. And that’s very exciting.

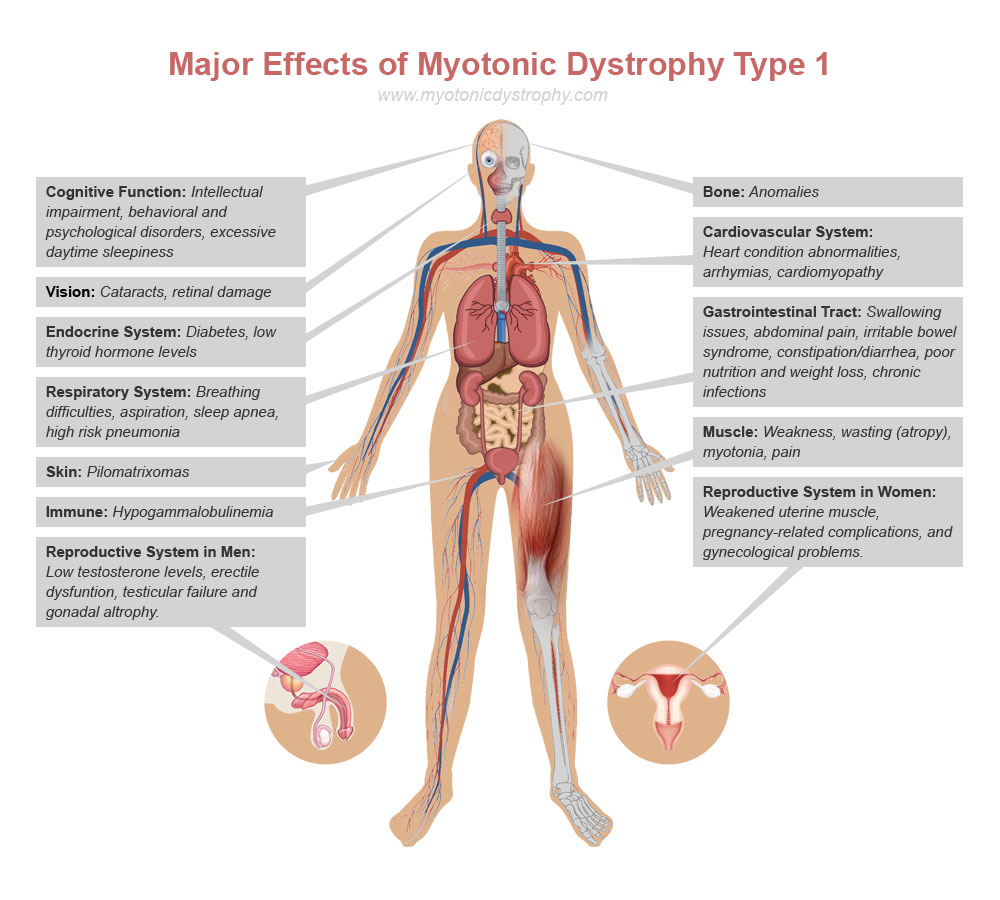

The incidence of the congenital form of myotonic dystrophy is much lower with an incidence of 1/100,000. A more recent study by Campbell in Canada put the incidence of the congenital form at 1/47,000 That means that most doctors will not have a patient with the disease in their practice. Thus, many people are turning to organizations like the Myotonic Dystrophy Foundation for help and assistance.

The incidence of the congenital form of myotonic dystrophy is much lower with an incidence of 1/100,000. A more recent study by Campbell in Canada put the incidence of the congenital form at 1/47,000 That means that most doctors will not have a patient with the disease in their practice. Thus, many people are turning to organizations like the Myotonic Dystrophy Foundation for help and assistance.